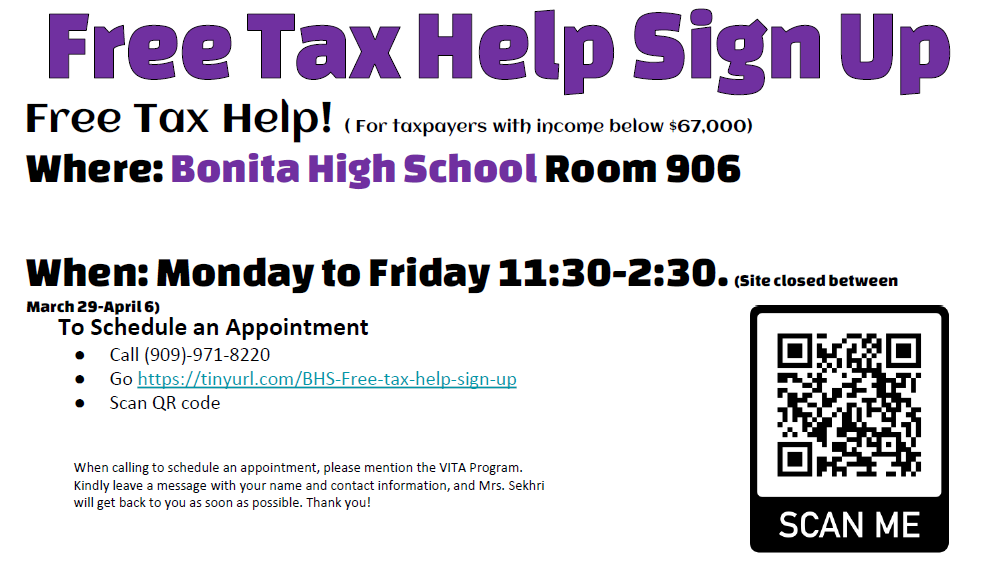

If you had a job last year and need to file your taxes, Bonita High School has you covered! Through the Volunteer Income Tax Assistance (VITA) Program, Mrs. Sekhri’s Accounting class is offering free electronic tax filing services for students and taxpayers with incomes below $67,000. Don’t miss this opportunity to file your taxes and receive your refund in just a few weeks!

How to Schedule Your Appointment

- To participate, schedule your free tax-filing session by visiting https://tinyurl.com/BHS-Free-tax-help-sign-up

- If you are interested in an appointment on The Tax day on April 8, go to https://tinyurl.com/BHS-TAX-Day-April8

Available Times:

Tax help is available during the following hours:

- (Monday through Friday, from 11:35 a.m. to 2:30 p.m.)

What to Bring

To ensure a smooth filing process, please bring the following items:

- Social Security Cards for all individuals listed on the tax return.

- Driver’s License or State ID.

- Routing and Account Number for direct deposit of your refund.

- Tax documents such as:

- W-2 forms

- 1099INT, 1099DIV, and 1099G forms

- Interest statements from savings accounts

- Stock dividend information

- A copy of the previous year’s tax return (if available).

- A pen to complete necessary forms.

Additional Documents for BHS Students

If you’re a Bonita High School student, please complete these additional steps:

- Free Tax Help Permission Slip: Pick up and fill out this form from Mrs. Sekhri in Room 906 or download it here: tinyurl.com/accountingform.

- Intake Interview Sheet: Available for download at tinyurl.com/Intakesheet.

Need Help or Have Questions?

For more details, contact Mrs. Sekhri:

- Phone: 909-971-8220

- Email: m.sekhri@bonita.k12.ca.us

Let Bonita High School’s talented accounting students guide you through the tax-filing process. This is a fantastic opportunity to learn, save money, and get your refund faster. Act now—appointments fill up quickly!